Non-negligence cover is also known as party wall insurance. It is particularly relevant to property owners and developers that are carrying out significant works. It should provide them with cover against claims from any neighbours whose property has been damaged by the construction work. As the name suggests, the policy steps in when the contractor is found not to have been negligent.

This type of insurance is particularly valuable because establishing negligence in construction-related incidents can be very challenging. It also serves to protect the property owner from potentially substantial financial exposure.

When Would Party Wall Insurance Be Required?

To potentially confuse matters further, non-negligence cover can also be referred to as “6.5.1 Insurance.” This is due to the requirement in Joint Contracts Tribunal clause 6.5.1 which mandates the cover. Other contracts may also stipulate non-negligent liability insurance. Policies are typically arranged in joint names, organised by the contractor but for the benefit of the property owner (or employer).

The services of party wall surveyors may be used to assess the works being undertaken. A Party Wall Award is typically used when neighbours cannot agree on the proposed works. It can help to address concerns before construction begins on matters such as arrangements for access and working hours, for example.

Surveyors will draw up a Party Wall Award and may include a recommendation to purchase suitable insurance. A Party Wall Award is a legally binding document that serves as a formal agreement outlining the details of construction work affecting a shared wall (party wall) between two properties. It specifies the scope of the approved work, timing, and necessary protections for both properties. The document also includes a schedule of condition, which records the condition of the adjoining property before the work begins, to protect all parties involved.

Please don’t assume that a contractor’s liability policy will deal with all disputes relating to a building development that they’re employed on. A contractor’s public liability policy will only respond to claims where the contractor is found to be negligent. If the contractor is not found to have been negligent, a neighbour to may direct a claim to the homeowner or the party that employed to contractor for the damages caused by the works. The Party Wall Act enforces a ‘strict liability’ on anyone commissioning building work and/or renovations. This means irrespective of whether or not there has been negligence, the party that instructed the work is liable to cover the costs of repairing relevant damage.

Plan Insurance can accommodate your Property Owners & Landlord Insurance needs. Just fill in our short call back form, and our professional brokers will be in contact to arrange your insurance.

Non-negligence cover is probably a more rounded description of the cover provided by this policy type than “party wall insurance”. This is because a physical party wall doesn’t need to exist under the Party Wall Act for there to be a liability. The Party Wall Act includes liability for structures in the vicinity of the works that are not necessarily attached to the building undergoing the work. If a third party property is within 3 metres, the Party Wall Act is very likely to apply as long as claimants can demonstrate that structural damage has occurred, and that it is the result of the works instructed by the renovator. Even properties further afield may also be eligible to claim.

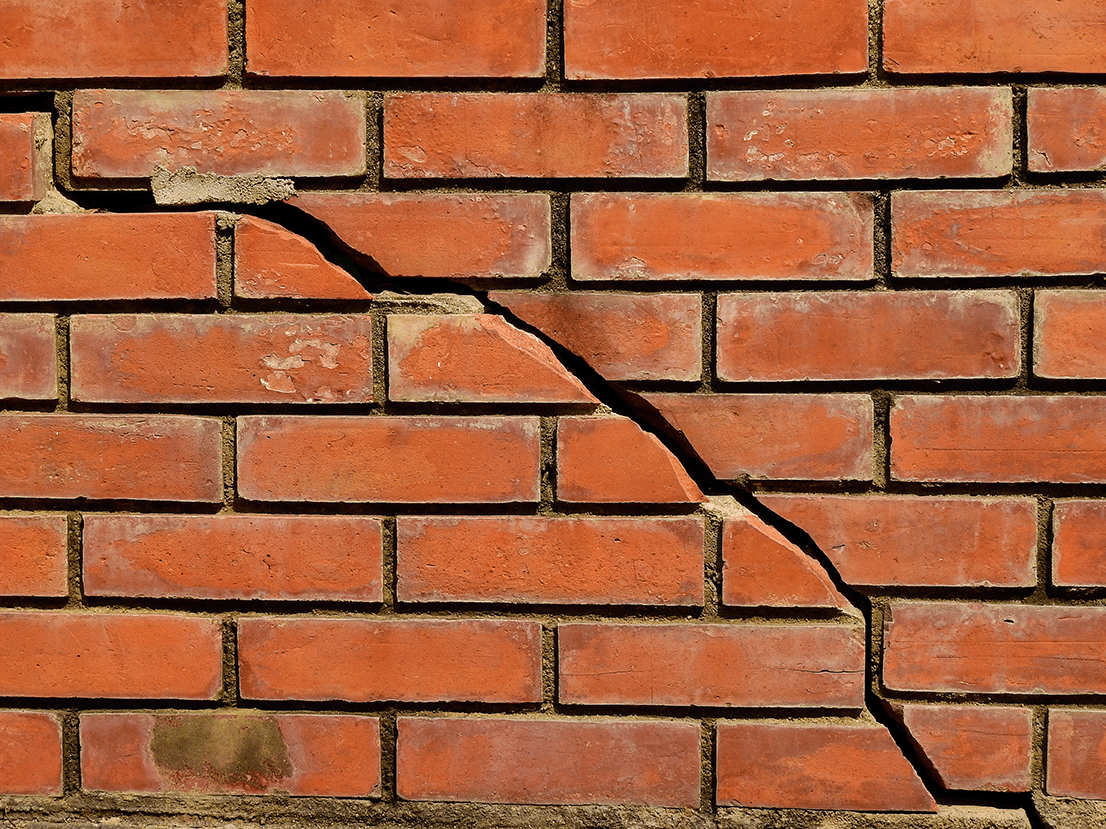

A good example is a case study where a contractor was carrying out works that resulted in damage to a neighbouring property due to significant vibrations. The contractor was not found to be negligent. Their public liability policy would thus not pay out. The property owner was left to foot the bill. This was due to the fact that as the employer, the property owner had a liability in tort for damage to third party property. In law, a tort is a civil wrong that causes harm or loss to another person, for which the injured party can claim compensation. It is distinct from criminal law, as tort actions aim to compensate the victim rather than punish the offender.

As well as vibrations, a non-negligence policy wording may also provide protection for third party property against several other risks such as: “collapse, subsidence, heave, lowering of ground water and weakening or removal of support.” Without it in place there is a strong possibility that these perils would be uninsured.

How Does Non-Negligence Cover Differ From Contract Works Insurance

Typically, standard property insurers do not cover damage to an existing building caused by a contractor, regardless of whether the contractor was negligent. In such cases, contract works and a party wall insurance policy can provide cover for damage to parts of the structure that were not directly involved in the construction work, even if the damage was not the fault of the contractor.

A contract works insurance offers protection for a renovator’s own property. However, contract works policies do not extend cover to any neighbouring buildings as standard. To properly safeguard neighbouring properties, the renovator should confirm that the contractor holds sufficient public liability insurance to cover any damage caused by negligence. Additionally, a non-negligence policy (a.k.a party wall insurance and 6.5.1 Insurance) should be in place to cover structural damage that may occur independently of any fault.

Expert advisers at Plan Insurance Brokers can arrange non-negligence insurance on your behalf. We will source high quality, tailored cover to meet your specific needs at a competitive premium. A comprehensive range of protections are available for homeowners undergoing work and contractors delivering developments. These covers include: renovations works, contract works, contractors combined with protection for plant and machinery, hand tools and a range of liabilities.

Find out why 96% of our customers have rated us 4 stars or higher, by reading our reviews on Feefo.